Which brazilian tax regime should you choose

- Pontes Vieira Advogados

- 10 de dez. de 2020

- 2 min de leitura

If you choose the wrong tax regime, you might actually lose money, paying more taxes than you should.

It’s important to remember that you’ll need to indicate which tax system to opt for in 2021. If you choose the wrong tax regime, you might actually lose money, paying more taxes than you should.

In Brazil, there are basically three systems of taxation for business income that the taxpayer can elect[1].

SIMPLES Nacional Tax Method

The first regime is called SIMPLES Nacional. This is a simplified system of tax payments, and is intended for small- and medium-sized companies – that is, for companies that generate a turnover of up to 4,800,000 Brazilian Reals per year[2].

Under the SIMPLES tax regime, eligible companies pay a single tax based on their monthly gross income.

The taxpayer will pay a progressive rate, established by law, according to its turnover and field of activity.

Unfortunately, there are some limitations to the SIMPLES tax regime, for example if the shareholder is located abroad, or it’s a company, as only individuals can be shareholders.

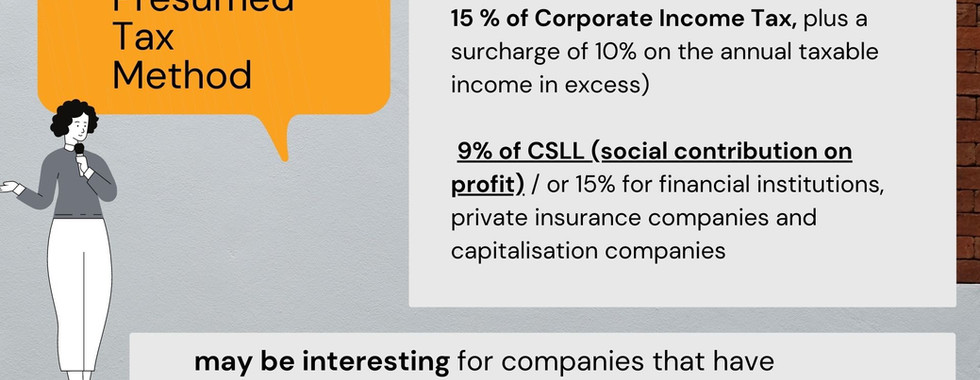

Presumed Tax Method

Under this method, income is established on a quarterly basis and should correspond to certain percentages, fixed by law, and applied over gross revenue. The presumed profit margins are basically 8 percent for industrial and commercial activities, and 32 percent for service activities, although there are some exceptions.

After finding a presumed profit, companies will be subject to a 15 percent of Corporate Income Tax , plus a 10 percent additional rate on income exceeding 20,000 BRL per month.

Thus, even if the company has achieved a higher profit margin, taxation will only be on the pre-fixed margin.

Presumed Profit may be interesting for companies that have profit margins higher than the presumed rate, have a low operating costs, and with a low payroll, however it is still necessary to verify whether or not the National Simples or Real Profit method would offer a better advantage.

But beware: if the actual profit margin is lower than the pre-fixed rate, taxes will be calculated on the presumed margin.

Real Profit Method

Under the Real Profit method, the income tax payed by a company is based on its actual taxable income, after computing all income, gains, cost and expenses. It can be calculated on a quarterly or annual basis.

In some cases, the Real Profit method is mandatory for legal entities. For example, this would be the case if the total annual revenues during the previous year exceeded 78,000,000 BRL.

After calculating a real profit, companies would be subject to a 15 percent of Corporate Income Tax, plus an additional 10 percent rate on income exceeding 20,000 BRL per month.

Real Profit method is usually a good choice if a company has profit, or if it began its operations with high expenses.

—

[1] The other tax regime is an Arbitrary Profit Method. This regime is used by Brazilian tax administration to assess tax based on arbitrary profit if a taxpayer fails to comply with the rules and regulation for keeping records and computing taxable income. In this sense, we do not consider it as an option for taxpayer.

[2] From 2021, this limit will be 4,800,000 BRL per year

www.pontesvieiraadvogados.com.br

info@pontesvieira.com.br

+55 11 2365-7484

Comentários